STRAIGHT FROM THE TRADING FLOOR

by Michael P. Reinking, CFA & Eric Criscuolo

DOW 48,058 (+497), S&P 500 6,887 (+46), Russell 2000 2,560 (+33), NYSE FANG+ 16,600 (-28), ICE Brent Crude $62.52/barrel (+$0.58), Gold $4,258/oz (+$22), Bitcoin ~92.3k (-309)

- A "hawkish cut"?

- Herding Cats

- Surprise balance sheet management

- All clear for the year end rally?

MAC Desk Commentary:

Since NY Fed President Williams speech on November 21st markets prepared for a “hawkish cut” today i.e. cutting rates while suggesting that the bar for further easing had been raised. One could argue that was delivered in the prepared materials released at 2:00. However, there was a dovish surprise related to “reserve management”. Let's start with the basics before we go there.

In the statement the description of economic growth and inflation remained the same. The labor market language was downgraded slightly by acknowledging the recent uptick in the unemployment rate. Forward guidance was updated in a more hawkish manor including “the extent and timing of” additional adjustments, which is the same language used last year when the Fed paused the easing cycle. Earlier we suggested the number of dissents would be a good litmus test for Chair Powell’s cat herding abilities. There was only one additional dissent from last meeting, Austan Goolsbee preferring no cut, this could have been higher so I’d say he’s pretty good. However, the disparate views are more evident in the Summary of Economic Projections.

The big surprise in the statement was the change to balance sheet management with the Committee saying, “that reserve balances have declined to ample levels and will initiate purchases of shorter-term Treasury securities as needed to maintain an ample supply of reserves on an ongoing basis.” This will be carried out with the purchase of $40B/mo focused on T-Bills but could be up to 3yr maturities starting on December 12th running through April at which time purchases are expected to be reduced (NY Fed Operating Policy). This announcement was earlier and larger than most anticipated though there was some speculation that an announcement could come this week - most notably by Bank of America’s US Rates Strategist and former officer at the NY Fed Markets Group, Mark Cubana - bravo sir. During the press conference Chair Powell acknowledged the ample reserves threshold had been met faster than expected and that balance sheet would need to increase by ~$20B/mo just to keep pace with growth but there would be some front loading ahead of tax season. This was a dovish shift as the balance sheet will begin to increase again and will suck up a lot of expected issuance. However, this is not meant to be stimulative it is more precautionary to make sure the plumbing continues to work - though you won't convince everyone that it won't have an impact.

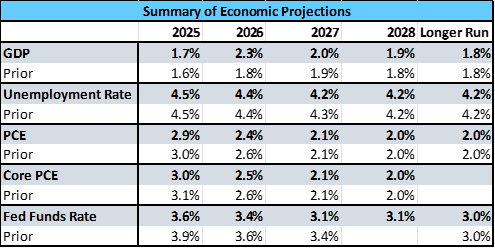

Within the Summary of Economic Projections GDP estimates were increased across the board. The 2026 estimate increased to 2.3% from 1.8%. Chair Powell acknowledged some of that uptick was related to the post government shutdown reacceleration but a more resilient consumer was also a factor. Unemployment rate projections were essentially unchanged ticking down from 4.5% this year to 4.4% in 2026. The PCE projections also ticked slightly lower. That mix of stronger growth, a steady labor market and moderating inflation is somewhat contradictory, but the Chair suggested it is due to an increase in productivity a point he reiterated multiple times throughout the press conference - say goodbye to the stagflation fears? The DOTS was the most hawkish part of the prepared materials and spoiler alert the press conference as well. There were 6 officials that called for no cut today. The median expectation for 2026 remained the same calling for 1 additional cut next year however, there were 7 officials that called for the Fed Funds rate to be between 3.5% to 4% (i.e. no cut today or next year).

The initial market response was tepid as investors feared Powell would drop\ the hawkish hammer during the press conference. Equities moved modestly higher. Yields initially moved lower but had reversed a good portion of that move by the time Chair Powell stepped to the podium.

The hawkish hammer never arrived, and his commentary felt more dovish than I think investors were expecting. His messaging about the labor market was pretty consistent saying it was “gradually cooling” and acknowledging the low hiring and firing environment. However, he did seem to elevate concerns about the labor market in the context of the dual mandate suggesting a bit more softening than previously thought highlighting that the jobs data may be overstated by 60k jobs/month.

On the other side of the dual mandate, his commentary about inflation was also pretty consistent noting anchored inflation expectations and pointing to progress in services inflation offsetting the tariff related goods inflation which he sees peaking in Q1.

Chair Powell noted that with the dual mandates in tension “there is no risk-free policy path”. He later said with the steps already taken that the Committee is now “well positioned to wait and see how the economy evolves from here.” In a slightly hawkish shift to his previous commentary, he said the policy rate is now “within the plausible range of neutral”. He did try to downplay how disparate the views are on the Committee calling it a healthy debate, saying there was “fairly broad support” for today’s action and noting this is what you would expect as you approach neutral. Chair Powell noted that there will be quite of bit of data before their next meeting however, he also highlighted the likely distortions in the upcoming releases.

Not surprisingly today’s decision was met with disappointment by President Trump. With the number of “soft dissenters” presumably at the regional bank level this will be an area to watch with all 12 Regional Presidents up for reappointment in February of next year.

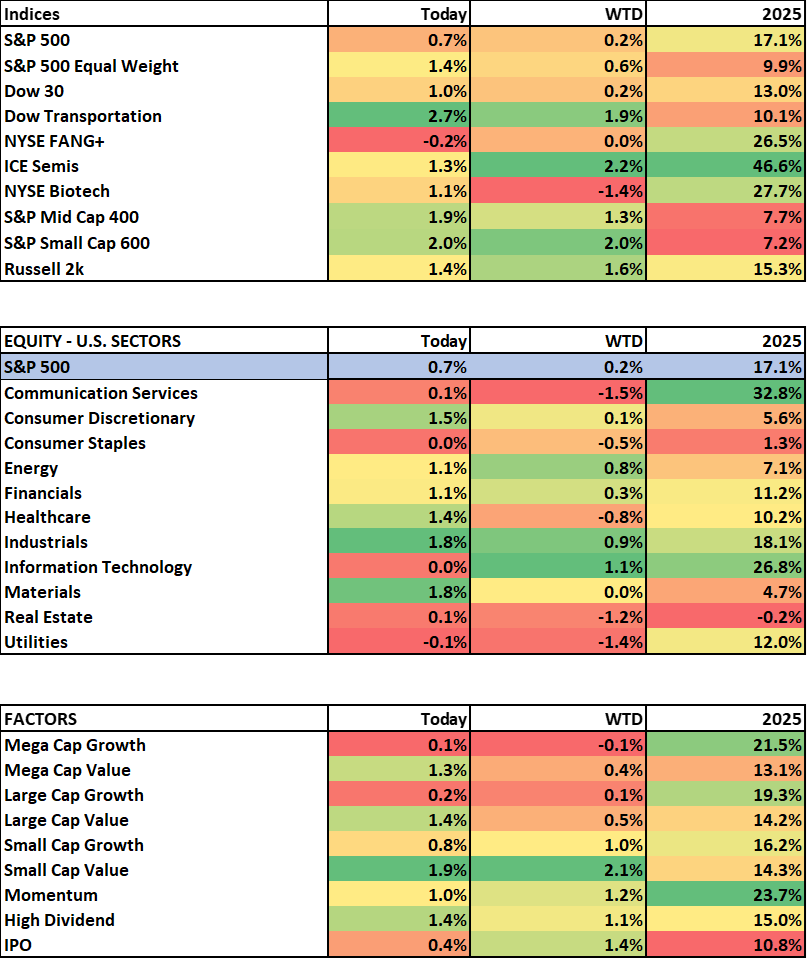

As the press conference went on equity markets moved higher and the broadening continued. The S&P 500 closed just below the all-time high up 0.7% but the equal-weight version of the index and small and midcap indices hit YTD highs up between 1.5% - 2%. In fact, the Russell 2k closed at a new all-time high. Mega-cap tech underperformed with the NYSE FANG+ ending down ~0.2%. It looks like we could see some more underperformance on that front tomorrow as Oracle is trading down ~10% in the after-market following its earnings.

There was some steepening in the yield curve with the 2yr falling 7bps while 10/30yr yields were down closer to 3bps. The ICE BofA MOVE index fell back below 70. The USD index fell ~0.5% which helped to put a bid back in the commodity complex. Crypto initially moved higher but has given back much of those gains over the last couple hours.

Quickly looking ahead the economic data includes claims, September trade balance, PPI and wholesale inventories. This evening there is a 20yr auction in Japan and there is a 30yr auction in the US tomorrow. Have a good night!

Connect with NYSE

By submitting this form you hereby expressly grant permission to use the information included thereunder to contact you for the purposes of sending periodic updates about ICE and/or its affiliates.

Your contact information will not be used for any purpose other than that for which your consent has been given. To learn more about our privacy policy, please click here.

© 2021 Intercontinental Exchange, Inc. All rights reserved. Intercontinental Exchange and ICE are trademarks of Intercontinental Exchange, Inc. or its affiliates. For more information regarding registered trademarks see: intercontinentalexchange.com/terms-of-usea