STRAIGHT FROM THE TRADING FLOOR

by Michael P. Reinking, CFA & Eric Criscuolo

DOW 49,016 (+12), S&P 500 6,978 (-1), Russell 2000 2,654 (-13), NYSE FANG+ 15,602 (-104), ICE Brent Crude $68.67/barrel (+$1.10), Gold $5,383/oz (+$301), Bitcoin ~89.1k (+177)

- Fed delivers a nothing burger

- Powell takes the high road

- Muted market response

- The focus shifts to tech earnings

MAC Desk Commentary:

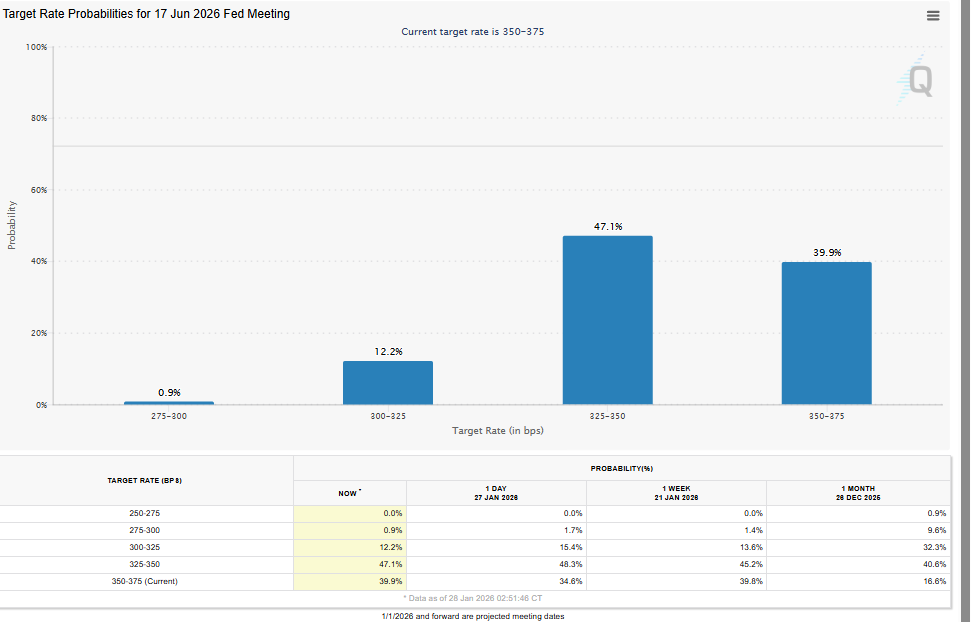

Even for the MAC Desk, which eagerly awaits every FOMC policy decision, this meeting has generated very little buzz. To set the stage, since the last Fed meeting in December the economic backdrop has remained status quo with the labor market in a low hire/low fire environment and inflation sticky above the Fed’s target. There are some differing opinions on the Committee, but most seem content with the current policy stance and will allow the data to guide further action. That backdrop along with the fact that data collection in the aftermath of the government shutdown (or lack thereof) muddied the waters a bit - pushed out market expectations for further action to mid-year.

As widely expected, the Federal Reserve left rates unchanged, but the Statement evolved in a hawkish direction. The description of economic activity was upgraded to “solid” from moderate. The Committee tweaked language related to the employment backdrop acknowledging the lower hiring environment once again but saying the unemployment rate had “stabilized”. Inflation language was unchanged. The Committee suggested that the balance of risks had shifted back towards equilibrium from tilted to downside risk to employment. Miran dissented on the vote, as expected, but only called for a 25bp cut, versus the 50bp cuts he has preferred since taking the role. He was joined by Waller, who also wanted a 25bp cut. Waller previously dissented in July when the FOMC held rates, favoring a 25bp cut along with Bowman. His odds to be nominated as the next Fed Chair nominee did jump after the statement was released but he remains firmly behind Rieder and Warsh.

When it comes to the Federal Reserve all of the recent buzz has been about independence, ongoing investigations and court hearings so we’ll quickly get that out of the way first. Not surprisingly, the press didn’t wait very long to ask questions about those topics but the Chairman would not take the bait. Apparently, Mr. Powell is a fan of Disney’s Encanto, as he added several verses to its hit song, “We Don’t Talk About Bruno”: We Don’t Talk About Other Officials’ Comments. We Don’t Talk About Subpoenas. We Don’t Talk About the Dollar and We Don’t Talk About My Job Status. The MAC Desk had been holding out some hope that President Trump would announce a new Chairman at 2:30 with the nominee breaking through the doors to Stone Cold Steve Austin’s theme music which would have made for some entertaining TV, but since that didn’t happen let’s talk about the rest of the rather boring press conference.

The prepared remarks from Chair Powell were consistent with recent messaging, reiterating that the current monetary policy rate is within the range of plausible estimates of neutral. When discussing the change to the language for the balance of risks the Chairman noted that tension remains but the upside risk to inflation and downside risk to employment have diminished adding that it’s hard to say that they are “fully” in balance. The Chairman acknowledged that economic activity has been more resilient than expected and that it will likely accelerate as the distortions of the government shutdown unwind. His take on inflation seemed rather sanguine once again noting that most of the overshoot is coming from tariffs which is expected to peak by the middle of the year, while there have been disinflationary forces on the services side.

Outside of the two dissenters Chair Powell said there was very broad support to keep rates unchanged and suggested that we could be here for some time pointing to the data as their north star going forward. There is no need to belabor the press conference as Chair Powell continued to seem very comfortable in the Committee’s current position. There were very minor changes to rate cut expectations with June being the first month where the probability of a cut exceeded 50%.

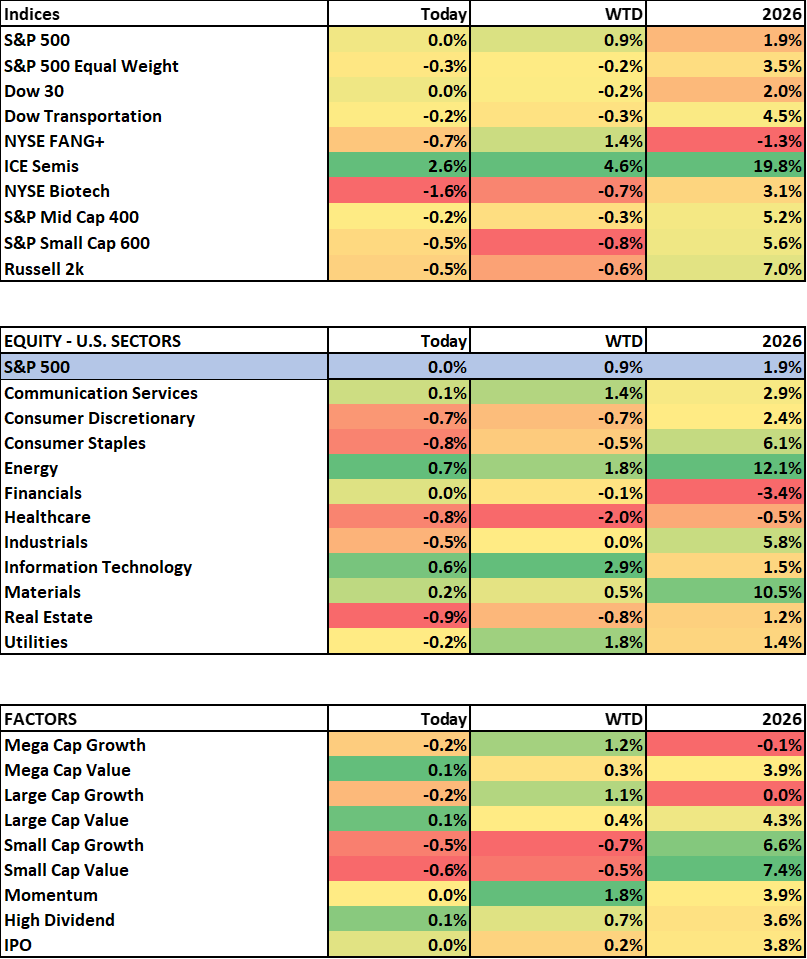

We described the press conference as rather boring and so was the market reaction. The S&P 500 traded in a 20pt range in the final two hours of trade ticking up a couple of points from where it was at 2:00.

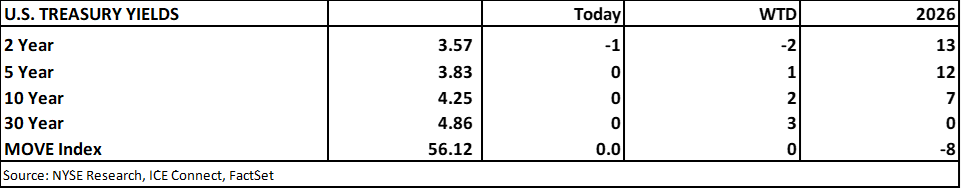

Treasury yields initially moved a touch higher but pulled back to end the day around unchanged. The USD index moved slightly higher after the policy statement but moved lower during the press conference.

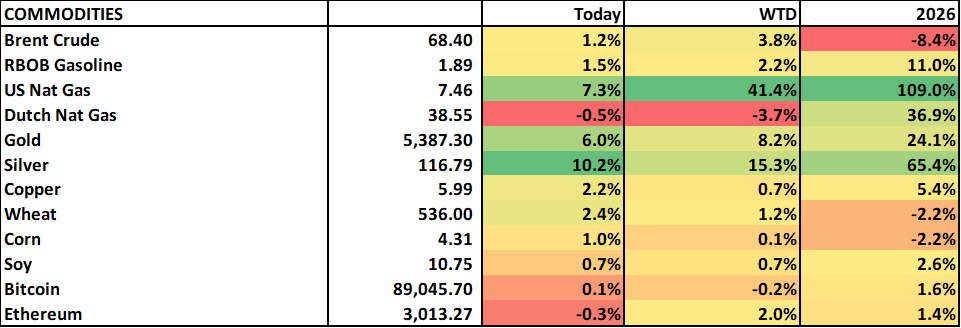

Within commodities precious metals continued to be the focal point with gold, silver and platinum all adding to earlier gains.

The Fed meeting was more or less bupkis, but earnings after the close should impact the market a lot more. Big tech stocks begin to report right as they look to regain their leadership position. IBM and Meta are up sharply and Tesla is higher as well. Meta’s 2026 capex guidance is $115-$135B, up over 70% from 2025 spend at the midpoint. The puts expected spending at more than Meta’s reported 2025 operating cash flow of $116B. Microsoft is down 4% despite solid top and bottom beats, with the initial weakness appearing to be on Azure posting inline-ish growth of 39% y/y. Blackstone will report before the open, providing a view into private and credit markets that are under some scrutiny. Mastercard (before the open) and Visa (after) report as well, with a check on consumer spending. Apple reports after the close, as does Western Digital and Sandisk, with the latest updates on the memory space, which has seen significant gains over the past month. In economic data, weekly jobless claims, productivity, Trade Balance and Factory Orders will headline the releases. Have a good night.

Connect with NYSE

By submitting this form you hereby expressly grant permission to use the information included thereunder to contact you for the purposes of sending periodic updates about ICE and/or its affiliates.

Your contact information will not be used for any purpose other than that for which your consent has been given. To learn more about our privacy policy, please click here.

© 2021 Intercontinental Exchange, Inc. All rights reserved. Intercontinental Exchange and ICE are trademarks of Intercontinental Exchange, Inc. or its affiliates. For more information regarding registered trademarks see: intercontinentalexchange.com/terms-of-usea