STRAIGHT FROM THE TRADING FLOOR

by Eric Criscuolo - Market Strategist

Published on 3/4/26

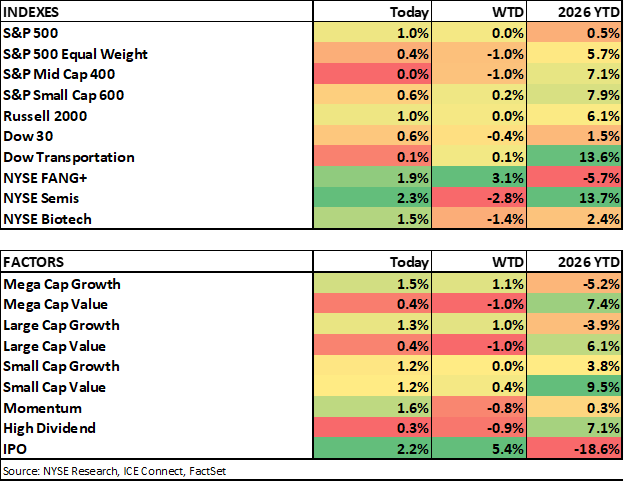

DOW 48,806 (+305), S&P 500 6,881 (+65), Russell 2000 2,632 (+24), NYSE FANG+ 14,901 (+273), ICE Brent Crude $81.55/barrel (+$0.15), Gold $5,136/oz (+$12), Bitcoin ~73.6k (+5538)

- Home in the Range

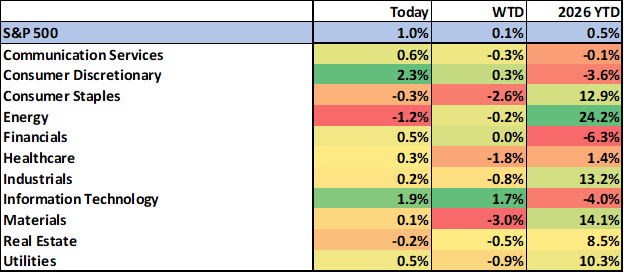

- 8/11 sectors higher; Discretionary, Tech leading; Staples, Energy lag

- Crypto sharply higher; Crude, yields settle down

- South Korea sharply lower; Europe higher

- Check out some of the recent ICE Data/Content:

- Inside the ICE House

- Episode 516: Radian CEO Rick Thornberry & Inigo's Richard Watson on a Defining Insurance Acquisition

- ETF Central: Former NFL Star & Champion Venture Partners' Marques Colston

- February 2026 ICE Mortgage Monitor Report: Early-January Rate Decline Unlocks Refinance Opportunity for Nearly 5 Million Homeowners

- Market Story Lines

MAC Desk Commentary:

Yesterday as commodities continued to move higher, “war-flation” concerns grew, especially around uncertainty about the ability to transit the Strait of Hormuz. The S&P 500 extended to the downside after the open, trading down ~2.5% at the lows. After breaking the 100d moving average, the index retested the December low but bounced back to opening levels as Treasury yields moved ~10bps off their highs. Reports that the administration was considering providing military support to tankers moving through the Strait of Hormuz and potentially backstopping shipping insurance soothed some of the above concerns. The index couldn’t quite hold a move back above the 100d and finished down ~1% with all sectors lower. Financials and Comm Services outperformed while Materials and Industrials lagged. Both Monday and yesterday were marked by strong rallies off the lows in the midst of obvious geopolitical turmoil.

Today started on more positive footing- if you weren’t an investor in Asian equities. A NYT story suggested that Iranian operatives reached out to discuss terms of ending the war. That story was later contradicted by other sources but helped the S&P open modestly higher, then extend further to our current levels, up ~1%. What’s more, the S&P 500 is back to a familiar position between the 50d on the upside and 100d on the downside. This morning before the Open, Treasury Secretary Bessent said that the Section 122 tariffs would likely move up from 10% to 15% this week, keeping with prior comments from President Trump. This would last 150 days. Various agencies will need to produce required analysis that would support a transition to longer-lasting tariffs under a different authority- Section 301. In addition, Bessent said that the administration will make a series of announcements to mitigate the rise in oil prices, backing comments from yesterday.

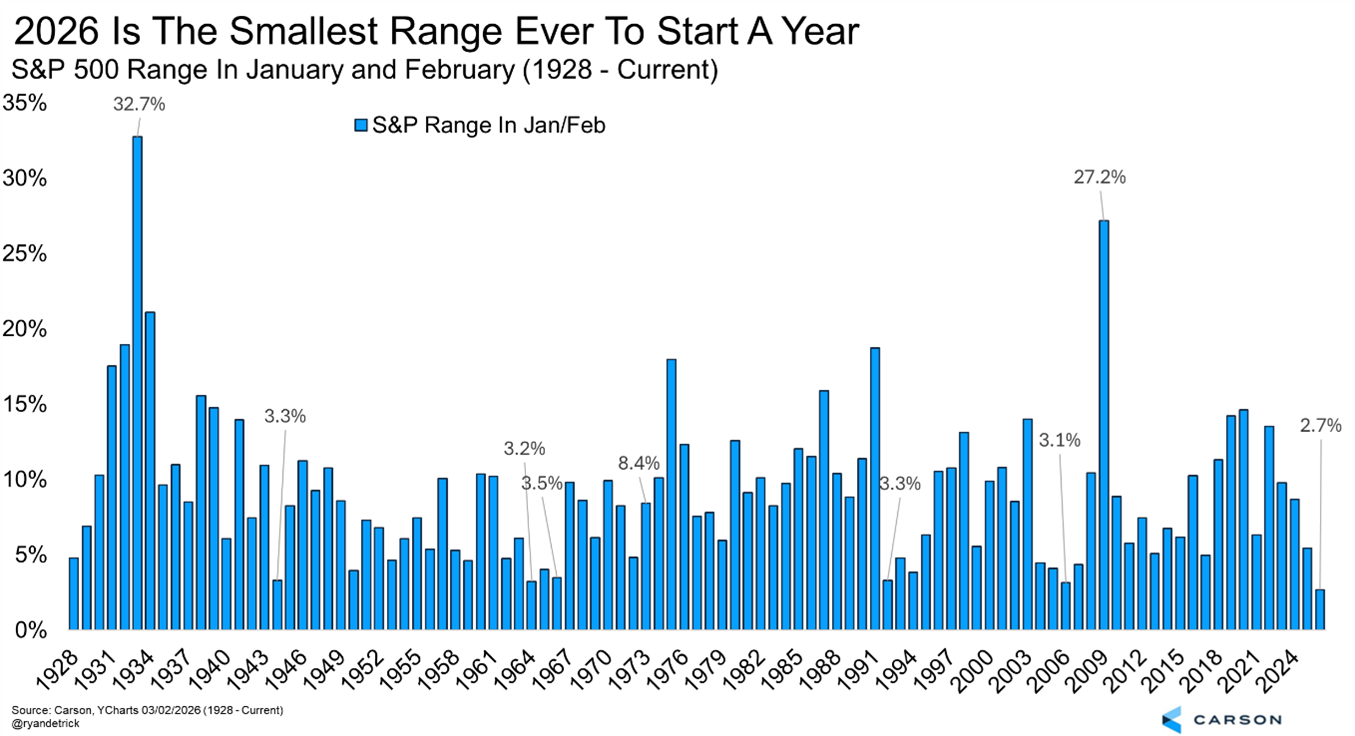

In an interesting post from Ryan Detrick of Carson Group, the S&P’s 2.8% range in January and February marked the smallest range ever to start the year (chart below). We’ve previously noted the extreme dispersion between the overall index and the constituents, which have seen much greater moves YTD.

The Russell 2000 and Dow are also up around 1%, while the S&P equal-weight is higher as well but lags. Growth is outperforming Value in the larger caps. 8/11 sectors are flat to higher.

Consumer Discretionary is the leading sector as mega caps see solid gains and travel-related stocks like cruise lines bounce. The automakers are higher- GM, F, TSLA +2 to 4% and Amazon is up 3%. Retail is mixed. Ross Stores and Bed Bath & Body are seeing gains after reporting earnings while Abercrombie is trading lower as investors fade Syndey Sweeney today. Ross management noted they are “very comfortable saying that we've seen growth very broad-based across income demographics, age demographics…”.

Tech is another leader. Software continues to recover from the latest SAAS-pocolypse sell-off (IGV +2%) but semis are slightly outperforming ahead of Broadcom earnings this evening and mega caps are higher (FANG+ up 2%). Financials are middle of the pack but two recently beat up areas- credit and crypto- are seeing strong gains. Coinbase is up 15%, Robinhood +8%. Digital Asset Treasury companies are sharply higher as the crypto complex rallies. Consumer credit cards and Private Credit names are up 1-4%.

Energy (crude flat, nat gas lower) is leading lower. Real Estate and Consumer Staples (broad weakness) are also lower though Target is modestly higher and hitting a 52-week high, following through on yesterday’s sharp gains from earnings and Investment Community Meeting.

Earnings after the close today include Broadcom, software names Veeva and Okta and Rigetti (Quantum computing) and retailers BJ’s, Kroeger and Burlington.

Treasury yields are slightly higher flat but moving in a much tighter range than recent action. The US Dollar Index is pulling back a little after sharp gains the past two days.

- US 2yr +1bps to 3.53%, 5yr +2bps to 3.66%, 10yr +1bps to 4.08%, 30yr +0bps to 4.71%

- USD index: -$0.14 to $98.87

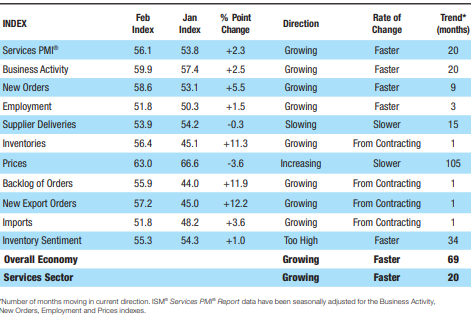

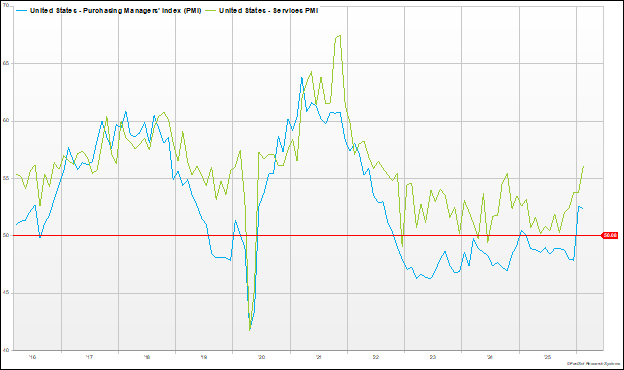

Final S&P Services PMIs of 51.7 were revised lower from the initial flash reading of 52.3. The February ISM Services PMI was stronger than expected, at 56.1 vs 53.5 consensus and up from last month’s 53.8. Almost all line items increased, including New Orders. Inventories, Backlog and Export Orders jumped. Adding to the positivity was that Prices was the category that fell, though it remains well above 50.

The Services report comes after the ISM Manufacturing PMI earlier this week showed a slight move lower from the prior number but still remained expansionary (>50) and pushed the cyclical trade, though prices jumped in that report.

The weekly ADP report was also strong, showing a jump in the 4-week average and coming in above estimates. That helped futures push higher approaching the Open. The Feb Beige Book was released at 2pm and doesn't look like it contains any significant changes from last month.

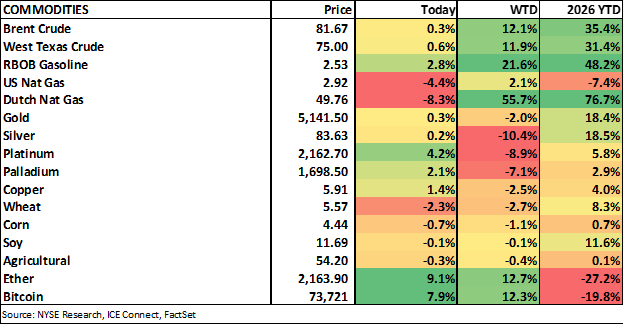

Crypto is up solidly with both Bitcoin and Ether +8%. After several failed attempts recently, Bitcoin cleared $70k on its way to $73k currently. Brent crude was slightly higher but is moving lower. Like yesterday an attempt to break above $84 was rejected. Nat gas is retreating (TTF -8% but up >50% this week). Gold and silver are flatish, following up the pullback to start of the week. Ag is modestly lower, with the complex showing restrained moves in the midst of the Iranian conflict.

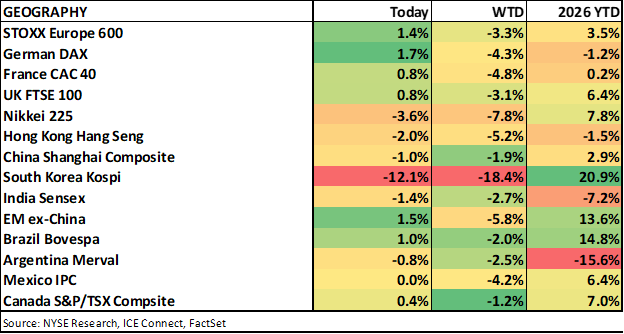

It was a rough overnight session in Asian markets which is an understatement when referring to South Korea’s Kospi. This has become one of the biggest momentum trades in the market and been on a parabolic move higher, driven by strength in memory companies Samsung and SK Hynix which make up nearly half the market capitalization. Overnight multiple circuit breakers were triggered with the index ending the session down ~12%, the worst single day decline in history, and down ~20% over the last two days. However it’s still up about the same amount YTD.

The Nikkei also fell over 3% for the second consecutive session. China PMI sets diverged, with the official NBS PMIs remaining in contraction and coming in slightly below expectations while the private sector report improved and beat estimates. Ahead of the National People’s Congress the Shanghai Composite fell 1% while the Hang Seng was down ~2%. European indices were solidly higher, led by Germany’s DAX as the region bounced after two days of declines. European PPI came in hotter than expected (similar to US) while unemployment was a little better.

Earnings:

- After-Market: AEO, AVGO, CBRL, EHAB, GO, OKTA, RGTI, STUB, VEEV

- Pre-Market (Thrs): AON, BJ, BURL, CIEN, JD, KR, VSCO, WLY

- After-Market (Thrs): COO, COST, GAP, GDYN, GWRE, IOT, MRVL, NX, PBR

Economic Data:

US:

- API Crude Inventories: 5.6M vs 2.19M cons, prior 11.4M

- Mortgage Apps: 6.1% vs prior -4.7%

- Refis: 14.3% vs prior 4.1%

- Avg 30y: 6.09% vs prior 6.09%

- Weekly ADP employment change: 63K vs prior 22K

- Final Services PMI: 51.7 vs flash 52.3

- ISM Services: 56.1 vs 53.5 cons, prior 53.8

- EIA crude inventories: 3.475M vs 2.3M cons, prior 15.989M

- 2:00pm Beige Book

Global:

- Japan Final Services PMI: 53.8 vs flash 53.8

- Australia Q4 GDP q.q: 0.8% vs 0.6% cons, prior 0.5%

- China Manufacturing PMI: 49.0 vs 49.1 cons, prior 49.3

- China Non-Manufacturing PMI: 49.5 vs 49.8 cons, prior 49.4

- China RatingDog Manufacturing PMI: 52.1 vs 50.0 cons, prior 50.3

- China RatingDog Services PMI: 56.7 vs 52.3 cons, prior 52.3

- India Final Services PMI: 58.1 vs flash 58.4

- Japan Consumer Confidence: 40.0 vs 38.2 cons, prior 37.9

- Taiwan Export Jan Orders y.y: 60.0% vs cons 50.9%, prior 43.8%

- Europe Final Services PMI: 51.9 vs 51.8 flash

- Europe Unemployment: 6.1% vs 6.2% cons, prior 6.2%

- Europe PPI m.m: 0.7% vs 0.2% cons, prior -0.3%

NYSE MAC Desk

Market Update

STRAIGHT FROM THE TRADING FLOOR

by Michael P. Reinking, CFA

Published on 03/04/2026 (a/o 9:15 am)

Good morning,

Yesterday, overnight as commodities continued to move higher, sparking “war-flation” concerns tied to the Strait of Hormuz closure equity future were under pressure at the jump. The S&P 500 extended to the downside after the open trading down ~2.5% at the lows. The index retested the December low after breaking the 100d ma, before bouncing back to opening levels as Treasury yields moved about 10bps off the overnight highs. Reports that the administration was considering providing military support to tankers moving through the Strait of Hormuz and potentially backstopping shipping insurance provided another boost. The index couldn’t quite hold a move back above the 100d and finished down ~1% with all sectors lower. Financials and Comm Services outperformed while Materials and Industrials lagged.

US futures were modestly lower overnight after sharp declines across Asia but improved as European markets opened. They have since turned positive after a NYT story suggesting that Iranian operatives have reached out through back channels to discuss terms of ending the war. S&P futures are near session highs up just under 0.5%. This morning Treasury Secretary Bessent said that the Section 122 tariffs would move up to 15% this week. In addition, he said that the administration will make a series of announcements to mitigate the rise in oil prices. ICE Brent is trading ~$81 about $3 off the overnight high.

Mixed reactions to several earnings today. For consumer-focused names, Ross Stores, Brown Forman and Bath and Body are trading higher while Abercrombie is lower. In tech CrowdStrike is flat while Gitlab is down ~10%. Wix is flat after announcing a $2B buyback will be largely completed this year, which would represent about half of its market cap.

This morning the ADP Employment Change came in ahead of estimates up 63k vs. 50k but last month was revised down to 11k from 22k. The smallest of small businesses (1 - 19 employees) accounted for nearly all of the job gains (+58k). Construction jobs on the goods side were up 19k, but manufacturing fell 5k. Within services education/health services increased 58k while professional/business services fell 30k, not a great mix. Pay for job stayers held steady at 4.5% while pay for job changers moderated to 6.3% with the spread between the two hitting a record low according to chief economist Dr. Nela Richardson. Treasury yields were modestly higher overnight but pulled back to around unchanged on the NYT story but there was minimal reaction to the data. The US Dollar Index is pulling back a little after strong gains the last two days. After the open final Services PMI will be released followed by ISM Services and the Beige Book this afternoon.

Government Yields

It was a rough overnight session in Asian markets which is an understatement when referring to South Korea’s Kospi index. This has become one of the biggest momentum trades in the market and been on a parabolic move higher recently, driven by strength in memory companies Samsung and SK Hynix which make up nearly half the market capitalization. Overnight multiple circuit breakers were triggered with the index ending the session down ~12%, the worst single day decline in history, and down ~20% over the last two days but it is still up about the same amount YTD. The Nikkei also fell over 3% for the second consecutive session. China NBS PMIs remained in contraction coming in slightly below expectations though the private sector ticked up to 53.8 from 53.7. Ahead of the National People’s Congress the Shanghai Composite fell 1% while the Hang Seng was down ~2%. European indices opened slightly higher and have been improving throughout session but keep in mind the indices closed down >3% yesterday, before US markets bounced.

Commodities are mixed. The energy complex is pulling back. Metals are bouncing after sharp declines yesterday. Ag is giving back some of yesterday’s move higher. Crypto held up pretty well yesterday and is moving higher this morning helped by comments from President Trump who met with Coinbase CEO Brian Armstrong telling banks to stop “undermining” the Crypto Agenda. Bitcoin is up ~5% trading just under 72k the highest level since early February. Ethereum is up a similar amount.

Earnings:

US:

Global:

Yesterday, overnight as commodities continued to move higher, sparking “war-flation” concerns tied to the Strait of Hormuz closure equity future were under pressure at the jump. The S&P 500 extended to the downside after the open trading down ~2.5% at the lows. The index retested the December low after breaking the 100d ma, before bouncing back to opening levels as Treasury yields moved about 10bps off the overnight highs. Reports that the administration was considering providing military support to tankers moving through the Strait of Hormuz and potentially backstopping shipping insurance provided another boost. The index couldn’t quite hold a move back above the 100d and finished down ~1% with all sectors lower. Financials and Comm Services outperformed while Materials and Industrials lagged.

US futures were modestly lower overnight after sharp declines across Asia but improved as European markets opened. They have since turned positive after a NYT story suggesting that Iranian operatives have reached out through back channels to discuss terms of ending the war. S&P futures are near session highs up just under 0.5%. This morning Treasury Secretary Bessent said that the Section 122 tariffs would move up to 15% this week. In addition, he said that the administration will make a series of announcements to mitigate the rise in oil prices. ICE Brent is trading ~$81 about $3 off the overnight high.

Mixed reactions to several earnings today. For consumer-focused names, Ross Stores, Brown Forman and Bath and Body are trading higher while Abercrombie is lower. In tech CrowdStrike is flat while Gitlab is down ~10%. Wix is flat after announcing a $2B buyback will be largely completed this year, which would represent about half of its market cap.

This morning the ADP Employment Change came in ahead of estimates up 63k vs. 50k but last month was revised down to 11k from 22k. The smallest of small businesses (1 - 19 employees) accounted for nearly all of the job gains (+58k). Construction jobs on the goods side were up 19k, but manufacturing fell 5k. Within services education/health services increased 58k while professional/business services fell 30k, not a great mix. Pay for job stayers held steady at 4.5% while pay for job changers moderated to 6.3% with the spread between the two hitting a record low according to chief economist Dr. Nela Richardson. Treasury yields were modestly higher overnight but pulled back to around unchanged on the NYT story but there was minimal reaction to the data. The US Dollar Index is pulling back a little after strong gains the last two days. After the open final Services PMI will be released followed by ISM Services and the Beige Book this afternoon.

Government Yields

- US 2yr -1bps to 3.51%, 5yr +0bps to 3.64%, 10yr +1bps to 4.07%, 30yr +1bps to 4.72%

- USD index: -$0.17 to $98.84

It was a rough overnight session in Asian markets which is an understatement when referring to South Korea’s Kospi index. This has become one of the biggest momentum trades in the market and been on a parabolic move higher recently, driven by strength in memory companies Samsung and SK Hynix which make up nearly half the market capitalization. Overnight multiple circuit breakers were triggered with the index ending the session down ~12%, the worst single day decline in history, and down ~20% over the last two days but it is still up about the same amount YTD. The Nikkei also fell over 3% for the second consecutive session. China NBS PMIs remained in contraction coming in slightly below expectations though the private sector ticked up to 53.8 from 53.7. Ahead of the National People’s Congress the Shanghai Composite fell 1% while the Hang Seng was down ~2%. European indices opened slightly higher and have been improving throughout session but keep in mind the indices closed down >3% yesterday, before US markets bounced.

Commodities are mixed. The energy complex is pulling back. Metals are bouncing after sharp declines yesterday. Ag is giving back some of yesterday’s move higher. Crypto held up pretty well yesterday and is moving higher this morning helped by comments from President Trump who met with Coinbase CEO Brian Armstrong telling banks to stop “undermining” the Crypto Agenda. Bitcoin is up ~5% trading just under 72k the highest level since early February. Ethereum is up a similar amount.

Earnings:

- After-Market (Tues): BOX, CRWD, GTLB, ROST

- Pre-Market: ANF, BBWI, BF.B, DY, EYE, WIX

- After-Market: AEO, AVGO, CBRL, EHAB, GO, OKTA, RGTI, STUB, VEEV

US:

- API Crude Inventories: 5.6M vs 2.19M cons, prior 11.4M

- Mortgage Apps: 6.1% vs prior -4.7%

- Refis: 14.3% vs prior 4.1%

- Avg 30y: 6.09% vs prior 6.09%

- Weekly ADP employment change: 63K vs prior 22K

- 9:45am Final Services PMI

- 10:00am ISM Services

- 10:30am EIA crude inventories

- 2:00pm Biege Book

Global:

- Japan Final Services PMI: 53.8 vs flash 53.8

- Australia Q4 GDP q.q: 0.8% vs 0.6% cons, prior 0.5%

- China Manufacturing PMI: 49.0 vs 49.1 cons, prior 49.3

- China Non-Manufacturing PMI: 49.5 vs 49.8 cons, prior 49.4

- China RatingDog Manufacturing PMI: 52.1 vs 50.0 cons, prior 50.3

- China RatingDog Services PMI: 56.7 vs 52.3 cons, prior 52.3

- India Final Services PMI: 58.1 vs flash 58.4

- Japan Consumer Confidence: 40.0 vs 38.2 cons, prior 37.9

- Taiwan Export Jan Orders y.y: 60.0% vs cons 50.9%, prior 43.8%

- Europe Final Services PMI: 51.9 vs 51.8 flash

- Europe Unemployment: 6.1% vs 6.2% cons, prior 6.2%

- Europe PPI m.m: 0.7% vs 0.2% cons, prior -0.3%

By submitting this form you hereby expressly grant permission to use the information included thereunder to contact you for the purposes of sending periodic updates about ICE and/or its affiliates. Certain indices mentioned above are administered by ICE Data Indices, LLC.

Your contact information will not be used for any purpose other than that for which your consent has been given. To learn more about our privacy policy, please click here.

© 2025 Intercontinental Exchange, Inc. All rights reserved. Intercontinental Exchange and ICE are trademarks of Intercontinental Exchange, Inc. or its affiliates. For more information regarding registered trademarks, limitations, restrictions, and other important information, please visit intercontinentalexchange.com/terms-of-use.