STRAIGHT FROM THE TRADING FLOOR

by Michael Reinking and Eric Criscuolo

Published on 3/6/26

DOW 47,502 (-453), S&P 500 6,740 (-91), Russell 2000 2,525 (-60), NYSE FANG+ 14,879 (-126), ICE Brent Crude $92.79/barrel (+$7.38), Gold $5,177/oz (+$98), Bitcoin ~68.2k (-2974)

For the last few weeks, the main topic within market circles has been the AI disruption trade which methodically rolled through sectors, seemingly with the release of each new Claude Code plug in. AI-Anxiety hit a fevered pitch last week after the Citrini thought piece pointed to a dystopian future where adoption of AI ultimately led to 10% unemployment. This weighed heavily on consumer-facing companies, payment processors and credit card companies, further adding to the weakness in the financial sector which had already been dealing with private credit concerns given exposure to software.

The Anthropic event last week, in which the company highlighted partnerships as opposed to displacements, calmed the waters. On Friday however, the final trading day of the month, payments firm Block announced it would cut 40% of its workforce. Founder Jack Dorsey cited the improvement in AI models as the driver. With the Citrini scenario fresh on everyone’s mind this damaged the market psyche again. The reasoning for the layoffs has been debated but it heightened concerns that, after a period of a low-hire, low-fire, there could be a wave of job cuts with companies blaming or crediting the technology, depending on how you look at it, re-popularizing the term AI-washing.

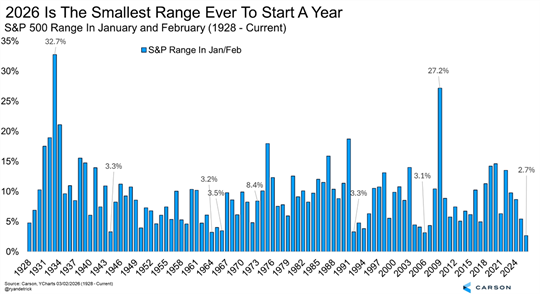

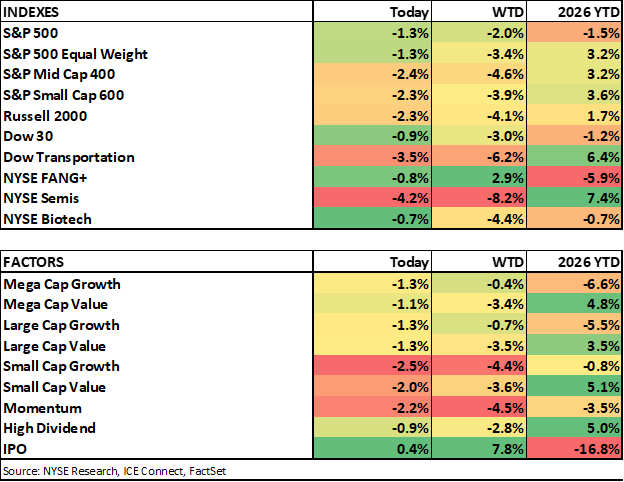

As we’ve seen throughout the year the losses at the index level were contained- most major indices ended the week down ~1%, but with wild dispersion beneath the surface as we’ve been noting here. Ryan Detrick of Carson Group highlighted that 2.7% range in the S&P 500 through the first two months of the year is the smallest ever. Barclays pointed out that the range for the average stock in the S&P 500 was about 7X that of the index, the largest ratio since they started tracking the data in 1994.

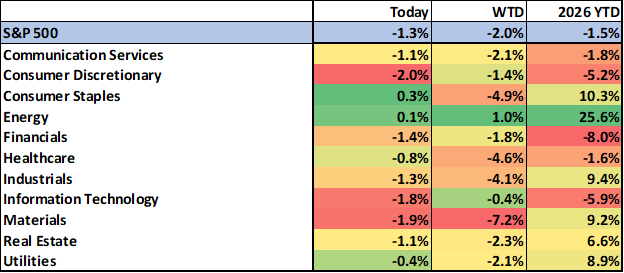

For the week and the month of February, Financials and Tech led to the downside with those sectors down between 4 - 5% in the month. Defensive sectors like Consumer Staples, yield-oriented groups and Energy led to the upside, ending last week up ~2% and well over 5% in February.

Beyond the AI concerns, some of that positioning was in response to the military build-up in the Middle East, alongside escalating warnings from the administration. There was some mixed reporting coming out of the negotiations with Iran last week but over the weekend diplomatic efforts were called off as operation Epic Fury was launched. Before we go any further, our thoughts and prayers are with all the service men and women and their families.

Keeping our view narrowly focused on market reactions, the first takeaway is that volatility has increased. Markets have responded to each airstrike/response, the potential length of the campaign and reports of backchannel negotiations. At this point the administration has suggested the campaign could last up to 8 weeks so this is a dynamic that could be with us for a while.

The initial reaction was to implement the typical conflict playbook. Equities were under pressure, oil rallied, precious metals moved higher and the USD had a strong safe haven bid. However, a corresponding haven bid for Treasuries didn’t emerge, with rising concerns of “war-flation” driven by the impact of higher energy costs and the potential closure of the Strait of Hormuz pushing yields higher.

The length of the conflict, impact on energy prices and the ability to transit the Strait of Hormuz are what markets are keying on right now. Between 20-30% of petroleum liquids move through the Strait and about a third of LNG shipments and key fertilizer ingredients ( ammonia and urea). There’s a disproportionate impact on Asia, which imports nearly 90% of that oil and ~80% of the LNG, and Europe, which takes in about 15% of the LNG. The US has become much more energy independent and is a key supplier to Europe, accounting for around 60% of the EU’s LNG imports.

The jump from diplomatic strain to kinetic conflict didn’t come out of left field though. As we’ve noted there’s been defensive positioning and portfolios seemed reasonably well hedged. This caused some of the initial weakness to get bought as traders were quick to monetize those hedges and buy-the-dip reactions were reengaged. Markets have tended to shrug off geopolitical catalysts, leading to the maxim “when the bombs fly it’s time to buy”. Commentary from the US administration provided some initial support, including that the administration is looking into providing military support to tankers in the Strait and backstopping shipping insurance.

As we’ve noted many times in the past, the increase in volatility across asset classes causes systematic de-risking with exposure taken down across the board. Crowded trades like long semis/memory short software was unwound as the NYSE Semis index fell 8% while the IGV Software ETF matched it on the other side, rising 8%.

The S&P 500 ended the week down 2%. The index managed to rally off significant declines and bounce off support at the 100d moving average throughout the week. However, that resilience cracked on Friday. The >1% decline pushed the index firmly into the red and the 100d failed to hold, gapping below it at the Open and never mounting a challenge to regain it. That also takes us to just above the December low ~6,720, with the rising 200d about 250 points below.

Consumer Staples and Materials, which have been two of the best performing sectors YTD are both down >5% for the week. Travel-related stocks have been under pressure throughout the week but the more defensive Consumer Staples sector underperformed Discretionary by 4%. On the year Staples has been outperforming Discretionary by 20%, highlighting the reversal.

Defense contractors and Energy stocks were notable outperformers as expected. Energy was the best-performing sector but gains were rather pedestrian given the oil move. And defense contractors couldn’t make up for the broad weakness in the rest of Industrials, which included the big construction equipment and electrical names that have shot higher on AI spending over the past year. Mega-cap tech showed some of the defensive qualities that we’ve seen over the last few years, with the NYSE FANG+ Index rising 3% and the Tech sector overall trading only modestly lower, with the semis/software rotation mentioned above. Materials was the worst sector, with outperformance YTD, rising input (energy) prices and economic disruptions weighing on the group and opening the door for rotation out of the names.

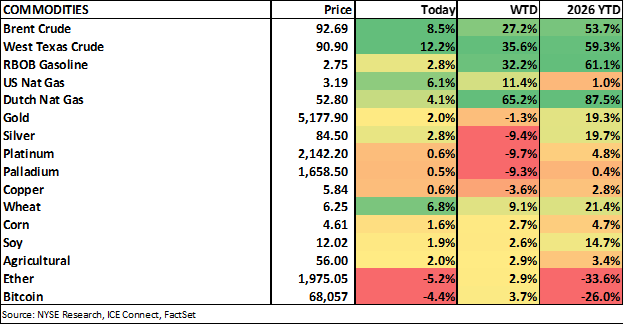

Commodities and Crypto - All about Oil but European gas skyrocketed

- Crude / gas - Crude had been moving steadily higher since the beginning fo the year. That action exploded this week as Brent flew ~30%, to over $90/barrel for the first time since April 2024. European Nat Gas (TTF) meanwhile screamed higher.

- Qatar’s energy minister, Saad al-Kaabi said crude prices could reach $150 in the coming weeks if tankers couldn’t pass through the Strait of Hormuz, which helped push oil higher at the end of the week. Several proposals have been discussed to contain prices, including SPR releases (Trump had said he wasn’t looking at that though), Treasury intervening in oil futures market, and waiving fuel-blend requirements. Treasury Secretary Bessent said the US would give Indian refiners a 30-day waiver to continue to purchase Russian crude. Meanwhile Bessent is considering asking China to reduce their oil purchases from US adversaries like Russia.

- Metals - Despite the conflict there wasn’t a sustained flight to precious metals, which sold off this week. While losses in gold were contained, silver, platinum and palladium fell 10%. Copper fell 4%. Rising yields and a strengthening Dollar weighed on group, and the longer-term runup and desire to take exposures down likely brought additional pressures on the complex. Silver fell below its 50d ma during the week. Friday saw modest gains across the complex however on the weak economic data.

- Agriculture - The group was up for the week, with wheat’s 8% gain leading. Those gains occurred late in the week after a Russian strike on Ukraine’s Chornomorsk port.

- Crypto - Bitcoin and Ether ended the week modestly higher due mainly to sharp gains on Wednesday when Bitcoin broke through $70k after several attempts over the past month. The rally stalled around $74k however, around the April ’25 lows from which it drove to its record high ~$125k. Ethereum continues to hang around $2k. After meeting with Coinbase CEO Brian Armstrong this week, President Trump warned banks to stop “undermining” his Crypto Agenda, which helped sentiment earlier in the week. We’ve also highlighted the correlation with software recently. If software maintains its hot streak we'll see how Bitcoin reacts.

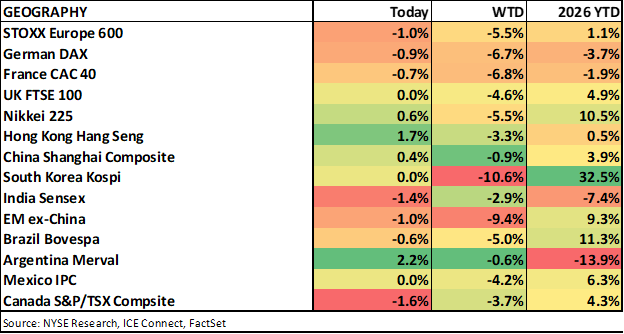

Global Equities - Global sell-off, Big moves in South Korea

- Europe - Major indexes were down ~7% for the week. Energy commodity prices, especially the mooning of Dutch TTF and ramping concern of LNG shipments, was a primary detriment. Yields also ripped higher, especially in the UK, weighing on equities.

- Asia

- China faired relatively well with Shanghai down only 1% and Hang Seng off 3%. The Hang Seng Tech index (KTEC ETF) was under pressure all week but rallied 3% on Friday to close down ~4% for the week. A lot of focus was on the National People’s Congress meeting, which included the official GDP target of 4.5% - 5.0%, largely expected.

- Japan fell over 5%. Energy concerns are magnified for the country due to its extreme reliance on imports (80-90% of energy supply). Almost all of its oil comes from the Middle East, 70% of which typically transit the Strait of Hormuz.

- South Korea’s Kospi saw declines of 7 and 12% on Monday and Tuesday and a 10% rally on Thursday before finishing flat on Friday to close out the week in what must have been exhausting for traders.

Economic Data

The February payrolls report on Friday was the main data event this week and it certainly caused a reaction. The print came in very weak, unexpectedly declining 92k compared to estimates for a gain of 59k, and significantly cutting in to last month’s 126k additions. The January numbers likely overstated strength. On the other hand, February's terrible weather and some strikes across industries may have overstated weakness this month. In any case, it wasn't great- at best an ugly print with messy details. Healthcare and Social Assistance, which have been driving most of the recent gains, had a big reversal, going from 116.4k additions in January to 18.6k losses in February. That delta made up more than the entire overall decline. Construction and Manufacturing, which were showing signs of awakening last month (+48k and +5k, respectively), fell to -11k and -12k. Trade, Utilities and Financial activities provided modest gains. Government jobs fell 6k. From the household survey, the unemployment rate rose from 4.3% back to 4.4% while the participation rate fell to 62.0% from 62.1% (revised from 62.5%). Updated population estimates had a significant impact on that part, accounting for the revision.

The ADP report on the other hand was solid, jumping from a downwardly-revised 11k adds, to 63k, the largest monthly growth figure since November 2025. However gains remain very concentrated: Education and Health Services led (+58k) which continued the trend seen in other reports (before Friday’s payroll data). Construction added 19k while Manufacturing declined 5k. Professional/business services led decliners, with -30k. Small and large-sized businesses added jobs. Weekly initial claims were essentially inline and unchanged while continuing claims ticked higher. Challenger job cuts were also positive, plunging from last month's high print (48k announced layoffs vs. 108k in January). AI was mentioned in the discussion of Tech sector job cuts.

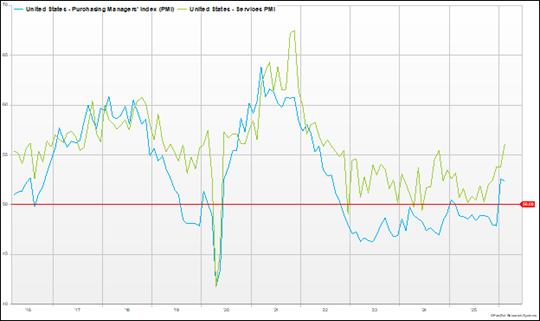

ISM February Manufacturing and Services reports were also important releases. The Manufacturing PMI ticked slightly lower from last month (51.6 vs 52.4), but beat estimates and remained in expansion territory (>50). New Orders expanded at a slower pace than January. The standout item though was the jump in Prices, from 59.0 to 70.5- its highest reading since June 2022. Commentary was mixed- maybe a little better than last month’s overall but prices were a big focus.

The Services PMI was stronger than expected, at 56.1 vs 53.5 consensus and up from last month’s 53.8. Almost all line items increased, including New Orders. Inventories, Backlog and Export Orders jumped. Adding to the positivity was that Prices was the category that fell, though it remains well above 50.

The Feb Beige Book didn’t contain many changes from last month. Preliminary Q4 Unit Labor Costs of 2.8% q.q were higher than consensus (+2.0%) and accelerated from last month’s -1.8% decline (and Q4’s -2.9%). However productivity beat estimates (2.8% vs 1.9%) though down from last month’ s 5.2%.

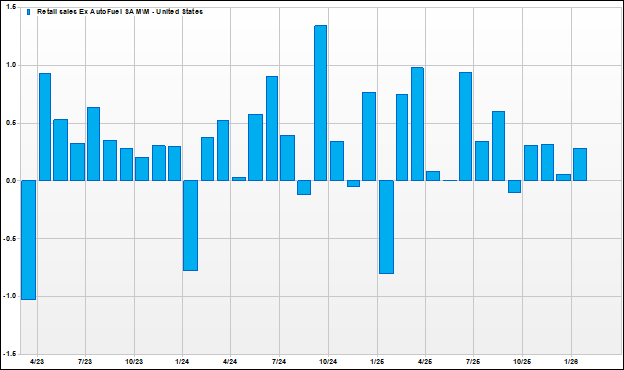

Advanced Headline Retail Sales for January came in light (-0.2%) but the Control Group, which feeds into GDP, outperformed (+0.3%). The big declines included Department Stores (-6.0%) Health/personal care (-3.0%), Gas Stations (-2.9%), Clothing/accessories (-1.7%), Motor vehicles/parts (-0.9%). Furniture/furnishings (+0.7%), building materials/supplies (+0.6%), and miscellaneous and nonstore (i.e. online) (+2.0%).

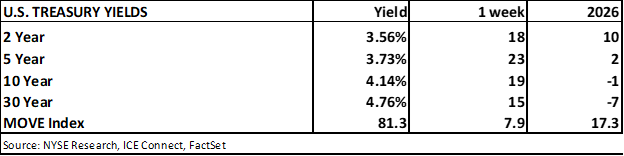

Yields and Currencies

There was no safety haven bid for Treasuries for most of this week. Yields rose over 15bp across the curve. The move would have been higher if not for Friday’s modest rally in Treasuries following the labor data. The 10y had just broken below 4.0% last week before ripping back up this week. Odds for a June Fed rate cut rose to 39% on Friday from 30% on Thursday after the jobs data, but had been 46% a week ago before the Iranian action began.

European yields also rose sharply, especially in the UK which saw gilt yields spike 20-30bp across the curve. The Iranian tensions coincided with a complete repricing for March rate cut probabilities from the BOE, from 80% before the conflict to 20%.

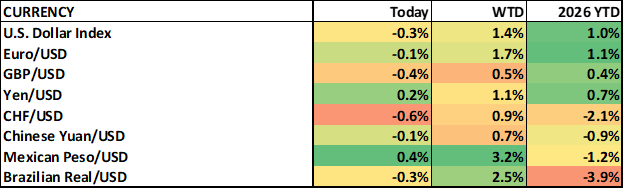

The Dollar saw strong gains this week on a confluence of haven bid and rising yields, though pulled back on Friday. It was stronger on all the major crosses, including other havens the Yen and Swiss Franc. The greenback had been strengthening since late January and the US Dollar Index cleared 99 before pulling back Friday.

What's on Tap Next Week

The Iranian conflict will of course be the focal point. CPI and the January PCE will headline the US economic data and JOLTS will provide a follow-up to this week's weak payroll report. Oracle, HPE, Constellation Software, Vail, Kohls, Dollar General, Dicks, Adobe, Rubrik and Ulta will be some of the prominent earnings reports. Lastly, the clocks move ahead one hour Sunday night. No excuses now. Take care and enjoy your weekend.

Calendar

- Weekend

- FOMC Blackout begins

- Sunday

- Daylight Savings - Clocks ahead one hour.

- Monday -

- Earnings Pre-Market: Constellation Software, DDD, HRTG, KFY, ZIM

- Economic Data:

- US: NY Fed Consumer Inflation Expectations

- Global: China CPI, PPI, EU Sentix survey, Germany Industrial Production, Mexico CPI

- Auctions: US 3/6mo

- Agriculture: USDA weekly crop inspections

- Earnings After-Market: CASY, HPE, MTN, RAIL, YEXT

- Tuesday -

- Earnings Pre-Market: ABM, ADCT, CTOS, GBLI, KSS, Nio, UEC, UNFI, WLFC

- Economic data:

- US: NFIB Business Optimism Index. ADP Weekly change, Existing Home Sales

- Global: China Trade Balance, Australia Consumer and Business Confidence, Japan GDP (final), Household Spending, Machine Orders, UK Retail Sales, Germany, France Trade Balance

- Central Banks:

- None

- Auctions: US 3y

- Energy: EIA STEO, API Oil Inventories (AMC)

- Agriculture: USDA Word Ag. Supply/Demand estimates

- Earnings After-Market: AVAV, BBCP, BLND, DOMO, FOA, IDT, LDI, ORCL, WMK

- Wednesday -

- Earnings Pre-Market: CPB, CXM, OPFI, SERV

- Economic data:

- U.S: CPI, Mortgage Applications

- Global: Japan PPI, Germany CPI

- Treasury: Monthly Budget Statement

- Central Banks:

- Speakers: None

- Auctions: US 10y, 17w, Japan 5y

- Energy: OPEC Monthly report, EIA Oil Inventories

- Earnings After-Market: FOSL, HPK, NTSK, NOA, SFIX, TLYS, PATH, VEL, WOOF, WLTH

- Thursday -

- Earnings Pre-Market: ALH, BBW, DKS, DG, SNBR, SEAT

- Economic data

- US: Jobless Claims, Housing Starts, Trade Balance

- Global: Australia Consumer Inflation Expectations, India CPI, Canada Trade Balance

- Central Banks

- Fed Balance Sheet

- Rate Decision -

- Speakers: None

- Auctions: US 30y, 4/8w

- Energy: Natural gas inventories

- Earnings After-Market: ADBE, GDOT, KFS, LEN, PEW, PD, RBRK, S, TTAN, ULTA, ZUMZ

- Friday -

- Earnings Pre-Market: BKE, DOUG, EEX, RLX

- Economic data

- US: PCE, GDP 2nd est., JOLTS, Durable Goods, Personal Income/Spending, Michigan Sentiment

- Global: Germany Wholesale Prices, UK GDP, Trade Balance, Europe, UK, Italy Industrial Production, Canada Employment

- Central Banks

- Speakers: None

- Commercial Bank Balance Sheets

- Auctions: Korea 50y auction

- CFTC COT

- Energy: Rig Count

- Earnings After-Market: None

Connect with NYSE

By submitting this form you hereby expressly grant permission to use the information included thereunder to contact you for the purposes of sending periodic updates about ICE and/or its affiliates. Certain indices mentioned above are administered by ICE Data Indices, LLC.

Your contact information will not be used for any purpose other than that for which your consent has been given. To learn more about our privacy policy, please click here.

© 2024 Intercontinental Exchange, Inc. All rights reserved. Intercontinental Exchange and ICE are trademarks of Intercontinental Exchange, Inc. or its affiliates. For more information regarding registered trademarks, limitations, restrictions, and other important information, please visit intercontinentalexchange.com/terms-of-use.